Featured 1

Much of the coverage centring the surge in Non Performing Loans (NPLs) in the banking sector to record levels, reportedly the highest in the world today as a percentage of loans disbursed (35.7%), seems to be missing the point, rather mischievously. By choosing to focus on the extremely rapid increase in the stock of bad loans, it ignores the wholesale cleanup operation that the interim government, and specifically Bangladesh Bank, was forced to take on almost immediately after coming to office in the wake of last year's Uprising.

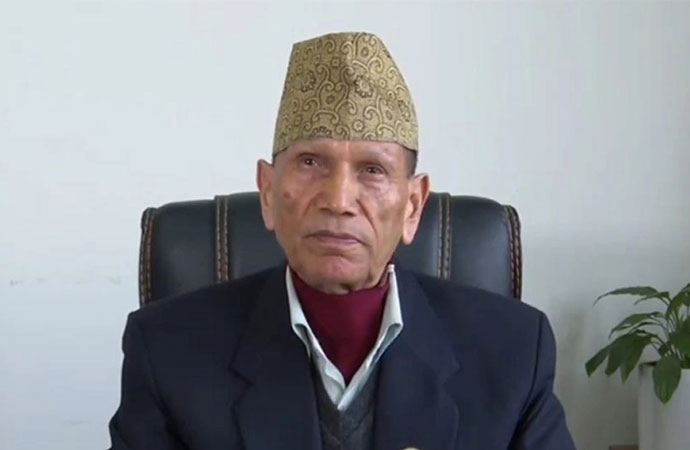

It is in the course of executing this clean up of the country's financial sector, for which we've been lucky to have the leadership of such a renowned economist as Dr Ahsan Mansur - that some of the worst excesses of the previous regime came to the fore. How one family-owned business was allowed to operate as a banking mafia, resulting in what the central bank governor described, in an interview with the Financial Times of London, as the "biggest, highest robbing of banks by any international standards". This same group was allowed to use manipulated takeovers, sometimes even at gunpoint, to take control of no less than seven banks - which is unheard of. It also featured the illegal provision of loans to newly installed shareholders, and inflated import invoices for its various companies from these banks, clearly unbothered about running them into the ground. Under Awami League, the country's banking sector had turned into the 'Wild, Wild West' of cowboys and gunslingers.

Dr Mansur could have chosen to not rock the boat - carry on in much the same way, hide the true picture as long as he could (eventually it would all come out of course) and safely add another feather to his cap. By doing the opposite, he chose the harder, less-trodden path that would benefit the country, at least in the long run. For that he must be lauded.

The ratio of bad loans was 16.93 percent of total outstanding loans at the end of September 2024, so they have more than doubled in just one year. But it isn't because more of their clients have been defaulting. It is mainly due to the exposure of funds siphoned off under the previous government that are only now beginning to be included under the NPL category, apart from the adoption of stricter international standards in the classification of loans - and sticking to them for the benefit they bring in the long term, instead of getting swayed by a nasty headline or two today.

Not that there was ever any danger he would do that of course, having told stakeholders privately that they should expect NPLs to soar past 40%, by the time the forensic audit he commissioned of banks' loan portfolios, through which a whole host of loans have been brought under the 'non-performing' category. Knowing the ins-and-outs of global finance probably better than any other Bangladeshi, Dr Mansur also made sure international partners were sounded out beforehand about the steps he was taking. So we should expect to see him continue in the same mould, continue to be bold, and finish what he started.

Leave a Comment

Recent Posts

Populism strikes again

So it is official now - the Bangladesh national team will not be trave ...

Beijing urges Washington to fo ...

China on Thursday reacted to China-related remarks by the US Ambassado ...

The European Union and the Mercosur bloc of South Am ..

New US Ambassador to Bangladesh raises concern over ..

Gold prices in Bangladesh surged past the Tk 250,000 ..

What is Trump's 'Board of Peace' and who will govern ..